Revolutionizing Financial Strategies: Embracing New-Age Technologies for Enhanced Efficiency

In today’s dynamic landscape, the phrase “revolutionizing financial services” resonates more than ever. This transformation, a fundamental shift in the financial sector, is fueled by groundbreaking technologies, reshaping the future of finance. Financial institutions are at the forefront of this transformative journey, leveraging fintech to revolutionize traditional Revolutionizing Financial methods.

Fintech: The Driving Force Behind Financial Innovation

Fintech, standing at the intersection of financial services and technology, is the driving force behind this revolution. It empowers institutions to offer a range of user-friendly services, reshaping the customer experience in the financial services industry. From banking services to non-banking products, fintech companies are innovating at an exponential rate, pushing the boundaries of traditional financial services.

Blockchain: Secure and Transparent Transactions

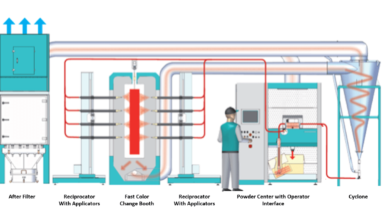

Blockchain technology is a cornerstone in revolutionizing financial transactions. It streamlines processes, ensuring secure and transparent transactions on a global scale. This automation, coupled with advanced technologies, is transforming Revolutionizing Financial management, offering seamless integration and enhancing customer satisfaction.

AI and Automation: Pioneering a New Era of Financial Services

AI-driven solutions, such as machine learning and natural language processing, are key in revolutionizing financial advice and services. These technologies automate complex processes and provide data-driven Revolutionizing Financial advice, ensuring a seamless and efficient customer experience. Financial institutions leverage AI and automation to offer a broad spectrum of services seamlessly, from traditional banking to innovative financial products.

Customer-Centric Approaches in Financial Services

The industry is undergoing a shift towards customer-centricity. This approach ensures that Revolutionizing Financial services are not only efficient but also tailored to meet the diverse needs of customers. By using artificial intelligence and machine learning, institutions can engage customers with user-friendly solutions, enhancing the nature of the financial system.

The Evolving Landscape of Financial Technology

The landscape of Revolutionizing Financial technology is continually evolving, offering exponential growth opportunities. Businesses are adopting new models, like Banking as a Service (BaaS), to create additional revenue streams. This change is not just about streamlining operations; it’s about offering a diverse range of services across various sectors.

Leveraging Advanced Technologies for Product Development

In the realm of product development, financial institutions discern the need for advanced technologies. These technologies not only streamline operations but also provide a competitive advantage in the market. They enable the creation of dynamic, user-friendly Revolutionizing Financial products and services that cater to the changing needs of consumers.

Read More about at Today Environment News

Conclusion

The financial services sector is revolutionizing the future of finance by embracing fintech, blockchain, and AI-driven technologies. This revolution is not just about enhancing efficiency; it’s about a fundamental shift in how Revolutionizing Financial services are provided. As we navigate this evolving landscape, it’s crucial to remember that with great technological power comes great responsibility. The future of finance lies in the balance of innovation, customer-centric strategies, and ethical use of technology.