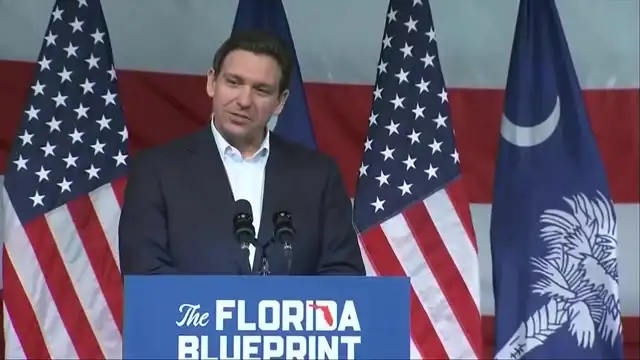

U.S. Treasury Department Urges Reconsideration of Florida’s Anti-Woke Banking Law

As you navigate the ramified landscape of financial regulations, a new minutiae demands your attention. The U.S. Treasury dept. warns against Florida’s anti-woke banking law has recently issued a stern warning regarding Florida’s controversial anti-woke financial law. This unprecedented move by federal officials underscores the potential far-reaching consequences of state-level legislation on the national financial system. As a stakeholder in the financial sector, you need to understand the implications of this unpeace between state and federal authorities. This vendible will delve into the Treasury Department’s concerns, unriddle the potential impact on financial practices, and explore what this confrontation ways for the future of financial regulations in America.

Treasury Department Issues Warning Well-nigh Florida’s “Stop W.O.K.E.” Law

The U.S. Treasury Department has recently issued a stern warning versus Florida’s controversial “Stop W.O.K.E.” law, citing potential economic repercussions and ramble concerns. This law, which aims to restrict banks from considering environmental, social, and governance (ESG) factors in their operations, has drawn significant criticism from federal officials.

Potential Economic Impact

Treasury officials oppose that the law could hamper Florida’s economic growth by limiting banks’ worthiness to manage risks effectively. By restricting ESG considerations, financial institutions may squatter challenges in adapting to evolving market trends and investor preferences, potentially putting Florida at a competitive disadvantage.

Constitutional Concerns

The Treasury dept. warns against Florida’s anti-woke banking law on ramble grounds as well. Officials suggest that the law may infringe upon banks’ First Amendment rights by dictating their merchantry practices and decision-making processes. This raises questions well-nigh the wastefulness between state regulation and corporate autonomy.

Call for Reconsideration

In light of these concerns, the Treasury Department urges Florida lawmakers to reconsider the implications of the “Stop W.O.K.E.” law. They emphasize the importance of maintaining a flexible and responsive financial sector that can write emerging risks and opportunities in a rapidly waffly global economy.

What Does Florida’s Anti-Woke Financial Law Entail?

Florida’s anti-woke financial law, officially known as Senate Bill 264, is a controversial piece of legislation that has unprotected the sustentation of the U.S. Treasury Department. This law prohibits state and local governments from considering social, political, or ideological beliefs when selecting financial institutions for contracts.

Under this law, banks and other financial entities are barred from using Environmental, Social, and Governance (ESG) criteria in their decision-making processes for state and local government business. The legislation aims to prevent what some lawmakers view as politically motivated financial practices.

The Treasury Dept. warns against Florida’s anti-woke financial law, citing potential negative impacts on the state’s economy and financial system. Critics oppose that the law could limit competition among financial institutions and potentially increase financing for taxpayers.

Proponents of the law require it to protect Florida’s economy from what they perceive as “woke” ideologies influencing financial decisions. However, opponents worry that it may hinder efforts to write climate transpiration and social inequalities through responsible investing practices.

As the debate continues, the U.S. Treasury Department urges reconsideration of this controversial legislation, highlighting the need for a well-turned-threeway to financial regulation and economic growth.

Potential Implications and Reactions to the Treasury Department’s Statement

Controversy and Political Divide

The Treasury Department’s warning versus Florida’s anti-woke financial law has sparked intense debate wideness political lines. Supporters of the law oppose it protecting consumers from discrimination, while critics requirement it infringes on financial institutions’ rights. This unpeace highlights the growing tension between state-level policies and federal oversight in the financial sector.

Economic Concerns

Financial experts warn that the anti-woke financial law could have unintended consequences for Florida’s economy. Some worry that major banks might reduce their presence in the state, potentially limiting wangle to credit and financial services for residents and businesses. The Treasury Department’s statement has inferential these concerns, suggesting that the law may mismatch with federal regulations and industry standards.

Legal Challenges Ahead

The Treasury Department’s warning signals potential legal battles on the horizon. Ramble law experts visualize challenges to Florida’s legislation, citing possible conflicts with federal anti-discrimination laws and First Amendment protections. As the situation unfolds, all vision will be on how state officials respond to the federal government’s stance on this controversial financial regulation.

Conclusion

Considering the implications of Florida’s anti-woke financial law, it’s crucial to weigh the Treasury Department’s concerns versus the state’s objectives. This unpeace between federal guidance and state legislation highlights the ramified interplay between financial regulations and social policies. Moving forward, you should closely monitor how this situation unfolds, as it may set precedents for similar laws in other states. Ultimately, resolving this mismatch will likely have far-reaching consequences for the financial industry, corporate social responsibility initiatives, and the wastefulness of power between state and federal authorities. Stay informed and prepared to transmute your financial strategies in this evolving regulatory landscape.