How to Prioritize Timely Payments and Avoid Credit Score Damage

When it comes to managing finances, one of the most important habits to develop is paying on time. It may sound simple, but staying on top of your payment schedule plays a major role in maintaining financial health, especially when your credit score is on the line. For individuals using financial services to support personal or business needs, timely payments are the difference between long-term growth and avoidable setbacks.

Delays in payment can quickly add up. They don’t just result in extra charges—they also impact your credit profile. And once your credit score starts to drop, rebuilding it takes time, patience, and effort. That’s why it’s crucial to make on-time payments a regular part of your routine.

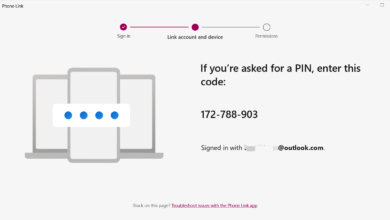

It all begins with understanding your repayment schedule clearly. Whether you’re paying back in weekly, monthly, or custom cycles, knowing when and how much you owe helps you plan your expenses better. A clear repayment calendar can prevent missed deadlines and give you the peace of mind to focus on other goals.

To stay consistent, setting up reminders is a smart first step. You can use a calendar app, an alarm, or even automated payments through your bank. These small steps remove the risk of forgetfulness and keep you on track without requiring daily mental effort.

But staying timely isn’t just about remembering the date—it’s about planning ahead. That means adjusting your budget to ensure you always have enough funds available before the due date. It might require shifting spending priorities, cutting back on non-essential expenses, or setting aside a specific amount each cycle that’s dedicated solely to repayments.

Even if you’re facing more than one financial obligation, prioritize the ones that are most urgent or have the biggest impact on your credit history. Missed payments on financial products or services that report to credit bureaus can create a ripple effect, reducing your score and limiting future opportunities. Tackling the most sensitive payments first can keep you protected in the long run.

In case you hit a rough patch or something unexpected comes up, the best move is to communicate early with your financial provider. Most institutions have support systems in place to help you realign your payment plan or offer flexible options. Reaching out not only shows responsibility but can also save you from penalties or credit damage.

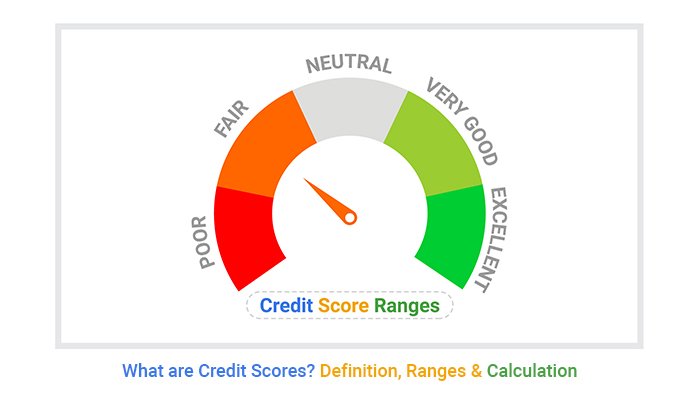

Keeping an eye on your credit score can also be a helpful motivator. Watching it improve over time through timely payments feels rewarding—and it’s an indicator that you’re managing your finances responsibly. It’s also a good way to catch any inaccuracies or issues before they become bigger problems.

The bottom line is simple: timely payments are about more than just avoiding fees. They build credibility, reduce stress, and protect your financial future. By staying organized, budgeting with intention, and communicating openly, you can avoid credit score damage and confidently move closer to your financial goals.