The Perilous Pursuits of Paul Singer: An In-Depth Analysis

Introduction to Paul Singer and his investing techniques

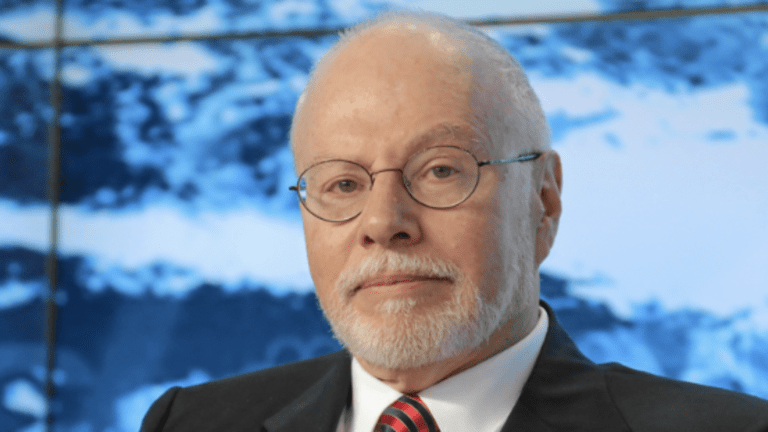

Paul Singer is a name that resonates throughout the financial world, often stirring up both admiration and controversy. As the founder of Elliott Management Corporation, his investing techniques have catapulted him to prominence. But what exactly sets him apart from other investors?

Singer’s approach blends traditional investment strategies with aggressive tactics that can leave even seasoned analysts scratching their heads. Whether he’s targeting distressed assets or engaging in high-stakes negotiations, Singer’s methods are anything but conventional. His relentless pursuit of profit has made headlines around the globe and sparked heated debates among investors and critics alike.

Join us as we dive deep into the perilous pursuits of Paul Singer—exploring his controversial tactics, notable battles, and lasting impact on finance while uncovering the man behind this complex figure.

The Controversial Tactics of Elliott Management

Elliott Management, led by Paul Singer, is known for its aggressive investing strategies. The firm often buys distressed assets and pushes for changes. This can ruffle feathers in corporate boardrooms.

Singer has a reputation for being relentless. He doesn’t shy away from public confrontations with company management. His approach includes advocating for restructuring or spinning off divisions to unlock value.

Critics argue that these tactics prioritize short-term gains over long-term stability. They claim this could jeopardize jobs and harm the companies involved.

However, supporters believe Elliott’s interventions can lead to necessary transformations. They see his methods as a way to enhance efficiency within struggling firms.

This duality of perception makes Elliott Management a polarizing force in finance, sparking discussions about ethics in investment practices while showcasing the fine line between activism and aggression in the stock market landscape.

The Battle Against Argentina

In the early 2000s, Argentina faced a severe economic crisis. This turmoil caught the attention of Paul Singer and his hedge fund, Elliott Management.

The country defaulted on its debts, struggling to recover while negotiating with various creditors. Singer saw an opportunity amidst the chaos—a chance to purchase distressed Argentine bonds at a fraction of their original value.

Elliott took a hardline approach in negotiations, demanding full repayment. The battle escalated as Argentina attempted to restructure its debt without settling with all bondholders. Singer’s firm became emblematic of aggressive investment tactics aimed at maximizing returns.

Legal battles ensued across international courts. These disputes highlighted the complexities surrounding sovereign debt and raised questions about ethical investing practices.

Singer’s relentless pursuit not only affected Argentina’s financial landscape but also influenced other nations grappling with similar issues. His determination left an indelible mark on global finance debates regarding investor rights versus national sovereignty.

Criticisms and Praise for Paul Singer’s Methods

Paul Singer’s investing methods draw a mixed bag of reactions. Critics often label his strategies as predatory. They argue that his aggressive approach harms struggling nations and corporations alike. This has led to significant backlash, particularly in the realm of sovereign debt.

Conversely, supporters praise him for his shrewdness and tenacity. They see him as a master negotiator who seeks value where others overlook it. His ability to turn distressed assets into profitable ventures showcases his talent for spotting opportunities.

Moreover, some investors admire Singer’s commitment to shareholder rights. He challenges management practices that they perceive as wasteful or inefficient. While not universally beloved, Paul Singer undeniably leaves an indelible mark on the investment landscape with his unique blend of tactics.

Impact on the Financial World

Paul Singer’s influence on the financial world cannot be understated. His aggressive investment strategies have set new benchmarks for hedge funds globally.

Through Elliott Management, he has pioneered a model where activism meets finance. This approach challenges traditional management structures and forces companies to reassess their operations.

Singer’s tactics often provoke strong reactions—both support and disdain. Critics argue that his methods create instability in markets, while supporters see him as a necessary force for accountability.

His focus on distressed assets has reshaped how investors view risk and reward. Many now follow his lead, adopting similar strategies to capture value in overlooked sectors.

Furthermore, Singer’s high-profile battles, like those against sovereign nations or large corporations, have raised questions about ethics in finance. These confrontations spotlight the power dynamics between investors and governments alike.

Personal Life and Philanthropy

Paul Singer maintains a low profile when it comes to his personal life. He is known for being fiercely private, often shying away from media attention. Born in 1944 in New York City, he grew up with a strong emphasis on education and hard work.

Singer’s philanthropic efforts reflect his values and interests. He has supported numerous causes ranging from education to medical research. His foundation focuses particularly on issues like LGBT rights and environmental conservation.

He believes that wealth should be used responsibly. This perspective drives much of his charitable giving. Through strategic investments, he aims not only for financial returns but also for positive social impact.

Despite the controversies surrounding him as an investor, Singer’s commitment to philanthropy showcases another facet of his character—one dedicated to effecting change through meaningful contributions.

Conclusion: Examining the Legacy of Paul Singer

Paul Singer stands as a complex figure in the investing world. His strategies and techniques have both captivated and repulsed many. With Elliott Management, he has built a reputation for aggressive tactics that often push boundaries.

His infamous battle against Argentina showcased his relentless pursuit of profits, drawing attention from around the globe. As controversies swirled, so too did debates about the ethics of his methods. Critics argue that his approach can harm nations already struggling financially, while supporters point to successful turns in distressed assets.

Beyond Wall Street’s glare lies Singer’s philanthropic side. He has consistently engaged in charitable endeavors through initiatives like the Paul E. Singer Foundation, focusing on various social causes. This duality—of being both a ruthless investor and a committed philanthropist—adds layers to how we understand his legacy.

As time unfolds, it will be interesting to watch how history frames Paul Singer’s impacts on finance and society at large. Will he be remembered solely as an opportunistic investor or also as someone who sought positive change? Only future reflections will paint this comprehensive portrait of one of modern finance’s most polarizing figures.

If you gained new insights from this article, be sure to explore our blog Today Environment News for more enlightening content.